Featured Articles & Resources Learn More! Surplus Funds Claims Claiming...

Read MoreIf you have received a letter or been contacted about having surplus funds you may wonder what they are.

Surplus funds are the leftover funds from the sale of your foreclosed house. The funds first pay off the mortgage debt, any property taxes due, legal claims, and any attorneys involved. After everything has been paid off, then the funds are available to the owner of the foreclosed home. Read “What are Surplus Funds” for more.

If you have been contacted by a finder do not sign anything. Your first step should be to contact an experienced attorney who works with surplus funds. (Fill out our contact us form or call us to complete this step!)

The surplus funds you receive are your very own pot of gold, but if you work with a finder it may turn into fool’s gold.

READ MORE ABOUT SURPLUS FUNDS FINDERS

LEARN MORE

Did you get a letter that says you're entitled to claim 'surplus funds'?

If you’ve received a letter from a Clerk of Court that says you’re entitled to ‘surplus funds’ – you’ve come to the right place!

Surplus Funds, also referred to as “excess funds,” or “overages,” is a term used to refer to any surplus (leftover) money that results from a foreclosure property auction when the winning bid exceeds the amount the lender requires to satisfy their lien. In other words, if the winning bid for the property is for more than what was owed at the time of foreclosure – the foreclosed-on owner may be entitled to the additional surplus amount after the lien has been paid off.

This ‘surplus’ money results from the sale of a foreclosed home if the winning bid exceeds the amount owed on the lien or property’s debt.

In order to claim these surplus funds, one has to file a Petition for Surplus Funds, explaining (aka proving) to the court how and why you are legally entitled to claim the funds.

There are typically no published or standardized claim forms for this particular type of funds claim.

Generally speaking, in order to file a claim for the funds, the claimant (presumably you) will need to engage an experienced attorney to assist in the drafting of a detailed petition laying out the facts and findings of the claim to file and present to the court, as well as, appear in court to represent you as the claimant in a ‘Special Proceedings Hearing’ (a type of court case) held by the Clerk of Court in the county where the funds are held.

So, what does it cost to file a claim for Surplus Funds?

The costs associated with claiming surplus funds to which you may be entitled generally includes (but is not limited to)-

A FILING FEE:

Typically, the filing fee is ~$120.00

(but may differ between counties)

THE ATTORNEY FEES:

the attorney fees for the lawyer representing you, often on a contingency basis

THE COST OF ‘SERVICE’:

the cost of service is the associated costs to notify any other legally ‘interested parties’ who may have a claim or dispute regarding these funds. This is done by the Sheriff’s office.

A LIMITED TITLE SEARCH:

a limited title search of your property to ensure that there are no other outstanding claims to be paid (generally between $150-250)

Counties all across the state of North Carolina have recently started sending letters to notify claimants of their claim to these surplus funds, even as far back as 2 (or more) years ago! So, if you have received a letter that you may have a claim to Surplus Funds, you should contact an attorney experienced with the process so that they can discuss the process of claiming the money being held by the State or County.

Download our FREE Guide

'5 Things You Should Know About Surplus Funds Claims'

Your Guide to Claiming Surplus Funds in North Carolina!

Download a copy of our guide to learn what you need to know about surplus funds claims TODAY!

If you’re looking for information on claiming surplus funds, you’re in the right place! Grab your copy of our FREE guide on claiming surplus funds (also referred to as excess funds) today!

More Resources

Claiming Surplus Funds in North Carolina

Have you received a letter from a Clerk of Superior...

Read MoreBeware of Greedy “Finders,” “Investors,” & “Asset Recovery Specialists”

There’s a wave of ‘get-rich-quick’ systems being peddled online these...

Read MoreFAQ: Frequently Asked Questions

https://surplusfundsattorney.com/wp-content/uploads/2025/02/10.mp4 Surplus Funds Claims Frequently Asked Questions Why Choose Us?...

Read MoreClaiming Surplus Funds in North Carolina

Did you get a letter that says you’re entitled to...

Read MoreThere’s a wave of ‘get-rich-quick’ systems being peddled online these days – a system that will teach you how to locate prime, untapped surplus funds that you can help recover – for a fee, of course, for property owners who likely have no idea this money even exists. All you have to do is track down the former property owners and provide them with the great news that they (who recently lost their property in a foreclosure) are owed MONEY! And, it’s usually a pretty decent amount of money! And aren’t they lucky!? An ‘Asset Recovery Specialist’ is right there to offer his or her assistance in recovering money for this unsuspecting victi – I mean client.

Read the fine print – and remember – if it sounds too good to be true, it probably is.

You have to be a licensed attorney to represent a surplus funds claim in court – so follow the money on these guys, and you’ll find out pretty quick why they’re charging close to 50% of your total claim to “help” you… helping you right out of around half of what you’re legally entitled to. This money already belongs to you – you just have to claim it and provide the proof.

You have to be a licensed attorney to represent a surplus funds claim in court – so follow the money on these guys, and you’ll find out pretty quick why they’re charging close to 50% of your total claim to “help” you… helping you right out of around half of what you’re legally entitled to. This money already belongs to you – you just have to claim it and provide the proof.

You may be contacted by someone referring to themselves as a "finders" "investor," or "asset recovery specialist'"- and they claim they just "want to help"!

Never sign anything until you’ve talked to us or another knowledgeable professional! You should never feel pressured to work with anyone – and you should never agree to pay more than 50% of your claim for help.

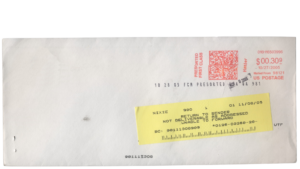

The county clerk’s office is tasked with trying to track down the rightful owners of any surplus funds they come into possession of- problem is – most of these folks lost the property (that was their home address) during the foreclosure that created the surplus – so they obviously no longer live at that address listed in the file!

While the foreclosing party and the clerk of court may send out notices to the former owner that they may be entitled to surplus funds, often it does not reach the owner because they have, of course, moved.

Because Investors can obtain information about surplus funds (foreclosure sales are public record), they may then offer to buy your interest in that money.

Surplus Funds Claims

Frequently Asked Questions

Our team of attorneys has the experience to help you recover your surplus funds claim – fast and at a fair price.

We don’t get paid unless we recover your money, so there’s never any risk to get started!

Prior to any petition to claim the surplus funds being filed in court, it is essential to have a title search for the owner of the property (whether living or deceased). A title search will show who is in the chain of title that might be owed money from an existing claim against the property.

The court will require a title opinion that shows there are no other potential claims on the money. These claims could be judgment liens (credit card judgments, for example) or tax liens, or even an unpaid second mortgage or equity line of credit.

Any person or entity in the chain of title who are owed legitimate claims against those surplus funds should be paid first before any payments can be made to the prior owner or heirs of the owner.

It may require opening an Estate in Court…

If the funds are from a foreclosure sale of property which belonged to a decedent (deceased person), for example, when the heirs of someone who died did not continue to pay the mortgage, and it was foreclosed upon, there will need to be an Estate* opened in order to distribute the money to the rightful heirs. This adds a layer of complexity and potentially expense.

Learn about our free claim review offer!

There are several factors that influence how long a surplus funds claim may take to file. On average, our claims usually take between 3-6 months to complete.

Some of the factors that can impact how long your claim may take to payout are

- The County.

- Each county has it’s own claims process so they will all have different turn around times.

- The age of the claim.

- If the funds have been “escheated” (that is, transferred) to the State Treasury, you can add another 2-3 months to the typical claim resolution time.

- How straightforward & responsive the claimant is.

- Being forthcoming with all the necessary case information is important so that we aren’t hindered by extra legal research to flesh out conflicting information. There is no need to hide anything from us. It will do nothing but delay your claim and make us sad. Don’t forget, as your attorney, everything we know about you is considered & treated completely confidential!

- How easy it is to contact and collect information from other potential claimants.

- How responsive all involved parties are.

- Outstanding Debt.

- Having a large number of outstanding liens on the property, or if there is a lot of outstanding debt still owed. These factors not only add to the time it takes to file the claim (you must contact each potential claimant to inform them of your claim to the funds) – but if the debt is legitimate, it reduces your overall payout by being paid by the surplus to make the lender whole again.

If you have a property that has recently been foreclosed upon, and you’ve been contacted by a finder offering to help you claim your surplus funds, give us a call at (919)-647-9599!

A finder is a person or business that for a fee will help in the recovery of property funds. The fee costs a lot of money for a service you don’t need. By working with us directly we help claim your surplus funds, allowing you to keep more of your money.

MORE INFO —

The legal definition of a finder in North Carolina is “an individual or business entity, incorporated or otherwise, who, for fee or any other consideration, seeks to locate, deliver, recover, or assist in the recovery of property that is distributable to the owner or presumed abandoned.” N.C.G.S. § 116B-52(11a).

However, finders must be licensed as a private investigator with the North Carolina Private Protective Services Board as of January 1, 2022- N.C.G.S. General Statute § 116B-78.1. So, we’ve found that frequently the finders contacting our clients are not registered as a valid business.

You can always consult the Treasurer’s website to look up properly registered finders.

Link: https://www.nccash.com/property-finder-information

As of January 22, 2024, there were only six (6) registered property finder entities legally operating in NC.

And, in every single case, an attorney will need to represent you in court to file a claim for surplus funds. As a matter of fact – the finder who is contacting you to “help” you claim your surplus funds – calls us next to file the claim for them anyway. So you end up footing the bill for the finder in the middle, and the attorney filing your claim in court. So – instead of wasting your time and money, skip the finders and call us so we can help you claim your surplus funds at a fair and reasonable price – and with the knowledge that it is being handled efficiently and effectively – by real attorneys who have experience filing these claims and know the ins-and-outs of this often complex legal process.

Don’t lose money and time on a service you don’t even need!

We provide the most user-friendly service for you to develop your software with the best user-experience design. You can come up with an idea, design plan or we are open for discussion to help you to develop your desired software efficiently.

What our clients are saying...

Check out what our clients' think about us...

“Highly recommend …”

“I highly recommend Jason and his team to help you recover surplus funds. They were fast, upfront, and fair.”

Redacted

“…Your team did an awesome job putting the pieces together …thank you!”

‘S’ and I would like to thank you and your team for making the process go smoothly. This was a very complicated situation that I created, but your team really did an awesome job of putting all of the pieces together and representing us.

C. Short

“Highly recommend their services”

[…] They were knowledgeable, friendly, professional, and fair with prices. They answered questions in a timely manner and kept us informed throughout the process. Highly recommend their services.

A. Tash

More Resources on Claiming Surplus Funds

Claiming Surplus Funds in North Carolina

Did you get a letter that says you’re entitled to...

Read MoreClaiming Surplus Funds in North Carolina

Have you received a letter from a Clerk of Superior...

Read MoreUncovering the (distressing) truth about surplus funds “finders” (aka READ THIS!)

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit...

Read MoreSurplus Funds aren’t Fools Gold

If you have received a letter or been contacted about...

Read MoreFAQ: Frequently Asked Questions

https://surplusfundsattorney.com/wp-content/uploads/2025/02/10.mp4 Surplus Funds Claims Frequently Asked Questions Why Choose Us?...

Read MoreDownload the

FREE Guidebook!

Useful Links

Useful Links

Have you received a letter from a Clerk of Superior Court stating you may be entitled to claim "surplus funds?"

What even are ‘surplus funds’ ?!

When a property goes into foreclosure –often due to a defaulted mortgage, unpaid property taxes, or even an outstanding lien, it is put up for public auction, so the lender can sell off the property to recover the money they are owed. Once the property has sold at this auction, the proceeds from the sale will go to settle any outstanding debts – like the mortgage balance, outstanding property taxes, or any judgments, liens, or other professional fees associated with the property. If there are any funds leftover after settling all the pre-existing (qualified) debt(s) – THAT leftover is what makes these “surplus” funds we are referring to – and these funds legally belong to the original property owner – not the bank, mortgage lender, courthouse, government or anyone else.

How do I file a surplus funds claim?

Once the property is sold and the surplus funds have been generated (and all prior debts have been satisfied), this money is handed over to the local clerk in the county the property was auctioned in for safekeeping until the rightful owner comes forth to declare ownership of the funds and stakes a claim to them. This basically means the property owner has to provide the proper evidence to show that they are, in-fact, entitled to make a claim to these funds as the rightful, legal claimant.

How is that done? In North Carolina, you must initiate a type of court proceeding called a “Special Proceeding” which allows a property’s ownership & debt history to be verified through a series of fact-producing petitions and hearings before the clerk will consider paying out a claim. Sadly, there are no court-provided claim forms available – nor a convenient website (like nccash.com) to claim this type of surplus property online.

How much does a surplus funds claim cost to file?

The costs associated with claiming surplus funds may include, but are not limited to –

- $120 in Court Filing Fees

*each county sets its own fees so this may vary a bit.

- Any Legal or Attorney Fees

Professional fees you may have accrued while filing your claim (and don’t forget – any valid property-related debts must be satisfied before you get your cut). These legal fees are for researching your claim, drafting your claim petition, filing & opening your claim case, preparing other legally required tasks, and representing you and your claim in court at your claim hearing.

- Misc Other Costs ( aka “Cost of Service”, Postage, etc)

Such as the preparation & postage costs associated with the ‘Notice of Hearing’ via certfified or otherwise trackable means (This Notice gives notice to any other legally ‘interested’ party a heads up that you are making a claim to this money and asserting that you are legally entitled to lay claim to it (so they have the time and opportunity to respond to your claim – including produce their own supporting evidence – or else be forever barred from staking a claim to any of these funds later). - This Notice must be sent via signature-required, trackable means (ex. USPS -certified mail, FedEx/UPS Signature Req)

- Legal/Case Research

Legal research necessary to document the facts of your claim. Typically, between $200-$500.

Let's get started on your claim!

Fill out the complimentary claim review form and we'll be in touch. Not ready? Then download our Guide to Claiming Surplus Funds in North Carolina to learn more about what to expect.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Truth About "Finders"

As of 1/24/24, there were only six (6) registered property finder entities legally registered to do business in NC.

In every single case, an attorney will need to represent your claim in court for you to make a claim to these surplus funds. So, instead of working with a finder, call The Walls Law Group instead so we can help you claim your surplus funds while letting you keep more of your money!

Featured Articles & Resources

Learn More!

Surplus Funds aren’t Fools Gold

If you have received a letter or been contacted about...

Read MoreClaiming Surplus Funds in North Carolina

Did you get a letter that says you’re entitled to...

Read MoreBeware of Greedy “Finders,” “Investors,” & “Asset Recovery Specialists”

There’s a wave of ‘get-rich-quick’ systems being peddled online these...

Read MoreFAQ: Frequently Asked Questions

https://surplusfundsattorney.com/wp-content/uploads/2025/02/10.mp4 Surplus Funds Claims Frequently Asked Questions Why Choose Us?...

Read MoreFeatured Articles & Resources

Learn More!

Surplus Funds aren’t Fools Gold

If you have received a letter or been contacted about...

Read MoreClaiming Surplus Funds in North Carolina

Did you get a letter that says you’re entitled to...

Read MoreBeware of Greedy “Finders,” “Investors,” & “Asset Recovery Specialists”

There’s a wave of ‘get-rich-quick’ systems being peddled online these...

Read MoreFAQ: Frequently Asked Questions

https://surplusfundsattorney.com/wp-content/uploads/2025/02/10.mp4 Surplus Funds Claims Frequently Asked Questions Why Choose Us?...

Read MoreRecent Articles

If you have received a letter or been contacted about having surplus funds you may wonder what they are.Surplus funds are the …

Did you get a letter that says you’re entitled to claim ‘surplus funds’? If you’ve received a letter from a Clerk of …

There’s a wave of ‘get-rich-quick’ systems being peddled online these days – a system that will teach you how to locate prime, …

If you have received a letter or been contacted about having surplus funds you may wonder what they are.Surplus funds are the …

Did you get a letter that says you’re entitled to claim ‘surplus funds’? If you’ve received a letter from a Clerk of …

There’s a wave of ‘get-rich-quick’ systems being peddled online these days – a system that will teach you how to locate prime, …

Recent Articles

If you have received a letter or been contacted about having surplus funds you may wonder what they are.Surplus funds are the …

Did you get a letter that says you’re entitled to claim ‘surplus funds’? If you’ve received a letter from a Clerk of …

There’s a wave of ‘get-rich-quick’ systems being peddled online these days – a system that will teach you how to locate prime, …

If you have received a letter or been contacted about having surplus funds you may wonder what they are.Surplus funds are the …

Did you get a letter that says you’re entitled to claim ‘surplus funds’? If you’ve received a letter from a Clerk of …

There’s a wave of ‘get-rich-quick’ systems being peddled online these days – a system that will teach you how to locate prime, …